(Oslo, Norway – October 24th, 2024) — Airthings (AIRX), a global leader in indoor air quality monitoring solutions, reported revenues of USD 10.0 million in the third quarter of 2024, on par with the same quarter last year. As in previous quarters, Airthings experienced strong growth and customer loyalty in the Consumer segment. While sales in the Business segment continued to lag due to challenging market conditions and order postponements, Airthings signed several medium sized deals signed in the quarter.

“I am pleased to report that we completed our announced restructuring and reorganization during the quarter, ensuring that we are well positioned to meet the continued strong underlying demand for our leading indoor air quality solutions. Our workforce has been reduced by 20 percent, and we have established a leaner organization and operating model. In line with our updated strategy, we will prioritize segments and solutions that are suitable to accelerate our path towards profitability and long-term value creation,” says CEO Emma Tryti.

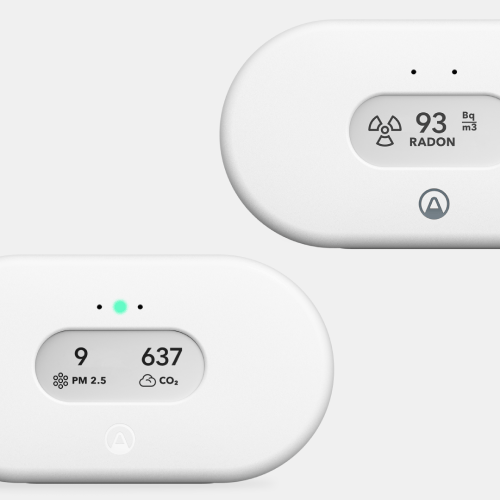

Revenues in the Consumer segment amounted to USD 7.7 million, corresponding to a revenue growth of 21 percent in the quarter. Safety concerns contributed to increased awareness around indoor air quality, driving demand for Airthings’ easy-to-use radon devices. Gross profit in the Consumer segment came in at USD 4.2 million in Q3 24, with a gross margin of 54 percent, down 5 percentage points from Q3 23, impacted negatively by channel mix, with a larger share of sales coming from retail where margins were under

pressure.

Revenues from the Business segment amounted to USD 1.8 million in Q3 24, down 42 percent year-on-year. The difference was mainly related to one large global enterprise customer deal in the same period last year. Repeat purchases from existing customers, both schools and large businesses, confirmed a high degree of customer satisfaction.

Stable annual recurring revenues supported a healthy gross margin of 72 percent in the quarter.

Gross profit for the third quarter was USD 5.8 million, showing a gross margin decline of 3 percentage points compared to the third quarter last year. The decline was caused both by

a larger share of total revenues coming from consumer sales, and by the channel mix within the Consumer segment.

“In line with our updated strategy, we are implementing a more data-driven approach to ensure an optimized supply chain and channel mix going forward. Balancing volumes and margins in retail sales will be important to ensure a good combination of distribution and profitable growth,” says CEO Emma Tryti.

Airthings expects the gross margin to be volatile from quarter to quarter, impacted by product and channel mix in the Consumer segment, and the timing of larger deals in the Business segment. For the fourth quarter of 2024, Airthings guides for revenues within the range of USD 9.5 - 12.0 million, with Annual recurring revenues (ARR) of USD 4.3 - 4.5 million expected at the end of the quarter.

In Q4 24, revenues may be negatively impacted by up to USD 1.2 million. Airthings has been approached regarding a possible buyback of inventory due to defective batteries in a product. The particular batteries are limited to one product and one batch of batteries delivered in 2022. Internal assessments of the issue and discussions with the customer regarding a resolution are ongoing. The maximum revenue effect is expected to be USD 1.2 million but can be lower. Airthings expects to conclude in Q4 24. Accurate revenue and EBITDA-effects will be reflected in the Q4 24 report.

“Although the EBITDA in Q3 is impacted by the expected one-off restructuring costs, we reiterate our target to become EBITDA positive in the second half of 2025. We also expect that our current operating plans remain fully funded until we reach break even, Tryti says.

The interim report and presentation are attached to this release and available on www.airthings.com/investors.

Practical arrangements:

The results for Q3 2024 will be presented by CEO Emma Tryti and interim CFO Magnus Bekkelund today at 08:00 (CET) at Danske Bank’s offices, Aker Brygge, Oslo. The presentation is open to the public and can also be followed via the following link:

https://events.webcast.no/airthings/presentations/3q-2024-presentation

For additional information or media requests, please contact:

Emma Tryti - CEO

T: +47 473 76 431

E: emma.tryti @airthings.com

Magnus Bekkelund – Interim CFO

T: +47 480 78 845

E: magnus.bekkelund@airthings.com

About Airthings

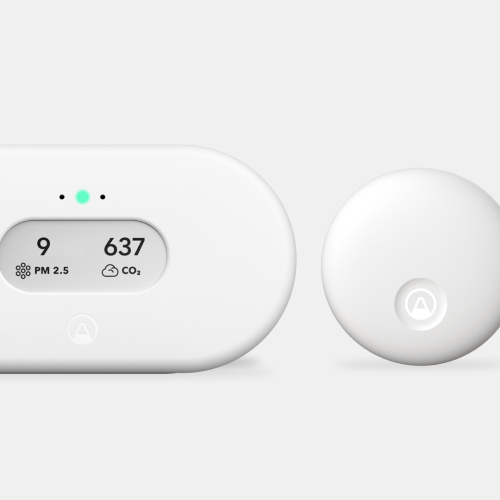

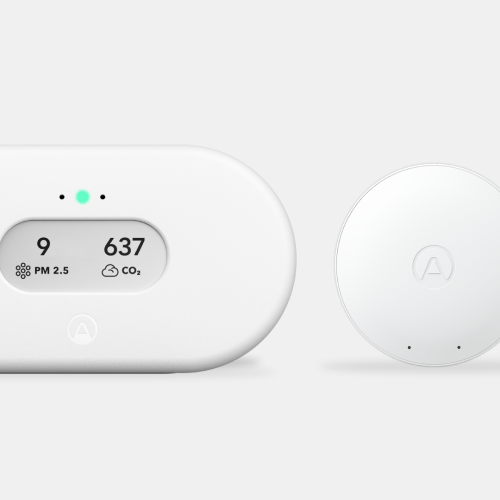

Airthings is a global technology company and producer of award-winning radon and indoor air quality monitors for homeowners, businesses, and professionals. Founded in 2008, Airthings is on a mission to ensure that people around the world recognize the impact of indoor air quality and take control of their health through simple, affordable, and accurate technology solutions while optimizing energy consumption in buildings. Airthings’ products have made radon detection and indoor air quality monitoring easy to deploy, accurate, and user friendly, and have received several accolades including the TIME's Best Inventions award and CES Innovation Award Honors. Headquartered in the heart of Oslo, Norway, and with offices in the US and Sweden the company has over 125 employees from more than 35 nationalities—and counting. To see the full range of Airthings indoor air quality monitors and radon detectors or to learn more about the importance of continuous air quality monitoring, please visit airthings.com.

%20(1)%20(1)%20(1).webp)

Back to top

Back to top