(Oslo, Norway – May 15, 2024) — Airthings (AIRX), a global leader in air quality monitoring and energy-saving solutions, reported revenues of USD 9.5 million in the first quarter of 2024, up 9 percent from the same period last year. Growth was driven by increased sales in the Consumer segment, showing a year-on-year revenue increase of 22 percent to USD 7.8 million in the quarter. ARR stood at USD 4.2 million at the end of the first quarter.

Gross profit amounted to USD 5.8 million in the quarter, corresponding to a 61 percent gross profit margin (GPM). This compared to USD 4.9 million and a GPM of 56 percent in the first quarter of 2023. EBITDA showed a loss of USD 1.8 million in the first quarter of 2024, compared to a loss of USD 3.2 million in the same quarter last year. Operating cash flow was positive at USD 0.1 million, supported by a continued reduction of net working capital.

“The first quarter was marked by strong growth in the consumer segment and the launch of our Renew smart air purifier. Revenues for the consumer segment were at an all-time high in the quarter,” says CEO Emma Tryti, who joined the company on March 1, 2024.

“In the business segment, we had a decline in revenues compared to last year due to the lack of large contracts during the quarter. The business segment is volatile, and heavily dependent on the timing of new and larger deals with individual customers, causing quarterly revenue fluctuations. We are pursuing a solid pipeline of deals, particularly in the US school district where we already have an ongoing pilot project,” adds Tryti.

In line with its updated strategy, Airthings implemented a more streamlined operating model last year to maintain revenue growth, strengthen gross margins, and reduce the cost ratio. This has generated positive results. Measured on a rolling last 12-month basis, revenue in the quarter increased 6 percent from the same period last year, with 4 percentage points higher GPM and lower operating costs. EBITDA losses were more than halved from USD 11.6 million in the last 12 months to the first quarter of 2023 to USD 5.5 million in the last 12 months to the first quarter of this year.

“We see continued progress on our path to profitability, as we are developing a scalable operating model and driving down costs,” adds Tryti.

For the second quarter of 2024, Airthings guides for revenues within the range of USD 8.0 – 10.0 million, with ARR of USD 4.3 – 4.5 million expected at the end of the quarter.

Practical arrangements:

The results for Q1 2024 will be presented by CEO Emma Tryti and interim CFO Magnus Bekkelund at 08:00 (CET) at Airthings ASA headquarters, Wergelandsveien 7, Oslo, Norway. The presentation is open to the public and can also be followed via the following link:

https://events.webcast.no/airthings/presentations/bgHnafKc0d9uGqde2uNf

For additional information or media requests, please contact:

Emma Tryti - CEO

T: +47 473 76 431

E: emma.tryti @airthings.com

Magnus Bekkelund – Interim CFO

T: +47 480 78 845

E: magnus.bekkelund@airthings.com

Resources:

About Airthings

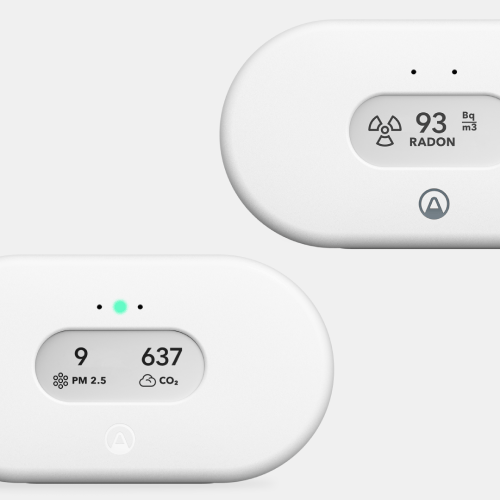

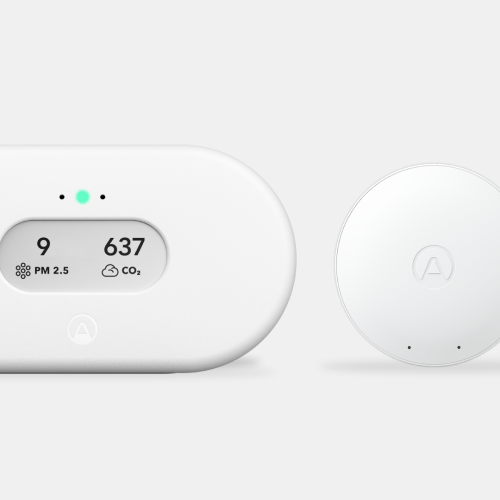

Airthings is a global technology company and producer of award-winning radon and indoor air quality monitors for homeowners, businesses, and professionals. Founded in 2008, Airthings is on a mission to ensure that people around the world recognize the impact of indoor air quality and take control of their health through simple, affordable, and accurate technology solutions while optimizing energy consumption in buildings. Airthings’ products have made radon detection and indoor air quality monitoring easy to deploy, accurate, and user friendly, and have received several accolades including the TIME's Best Inventions award and CES Innovation Award Honors. Headquartered in the heart of Oslo, Norway, and with offices in the US and Sweden the company has over 130 employees from more than 35 nationalities—and counting. To see the full range of Airthings indoor air quality monitors and radon detectors or to learn more about the importance of continuous air quality monitoring, please visit airthings.com

%20(1)%20(1)%20(1).webp)

Back to top

Back to top